Saturday, March 31, 2007

Friday, March 30, 2007

For fun, the President's Brain likes to "tear the tops off of small animals." Then it gets worse.

Bushies think this is funny. It's not. Put this guy in jail already.

Bush Failure Example #7,322

". . .these are signs of a military in decline and we must do something about it. The reasons are clear: lack of equipment and material, undermanning of units, over-deployment, not enough time for family, soldiers who are on food stamps and soldiers who are poorly housed.

Dick Cheney and I have a simple message today for our men and women in uniform, their parents, their loved ones, their supporters: Help is on the way."

Heckuva job, GW!

Thursday, March 29, 2007

A Reason to Shop at Best Buy

OK, it's not a mass firing, it's just a "wage management initiative" leading to a "separation" of 3,400 people. What b.s.

By the way, new CEO Phillip J. Schoonover made only $8.52 million in 2006. Maybe they should fire him and replace him with an entry-level worker at $8 an hour. That would save a lot of money and I'd bet most people wouldn't be able to notice any difference at Circuit City (except perhaps the 3,400 separated folks).

This is modern Darwinian Capitalism at its best...executive director of Change to Win Greg Tarpinian put it nicely:

"It's workers as disposable commodities, put in and put out based on whatever happens to the stock price".

Send old Phil an email. At least the stock is down today.

Tuesday, March 27, 2007

Monday, March 26, 2007

Impeach Bush

(CBS/AP) A prominent member of the Republican party said President Bush's go-it-alone approach on Iraq amounts to flouting Congress and the public, so angering lawmakers that some consider impeachment an option over his war policy.

Republican Sen. Chuck Hagel, a member of the Senate Foreign Relations Committee and a frequent critic of the war, stopped short of calling for Mr. Bush's impeachment. But he made clear Sunday that some lawmakers viewed that as an option should Mr. Bush choose to push ahead despite public sentiment against the war.

"Any president who says, I don't care, or I will not respond to what the people of this country are saying about Iraq or anything else, or I don't care what the Congress does, I am going to proceed — if a president really believes that, then there are — what I was pointing out, there are ways to deal with that," said Hagel, who is considering a run for president in the 2008 elections. Mr. Bush cannot run because of term limits [thank God].

In the April edition of Esquire magazine, Hagel described Mr. Bush as someone who does not believe he is accountable to anyone. "He's not accountable anymore, which isn't totally true. You can impeach him, and before this is over, you might see calls for his impeachment. I don't know. It depends on how this goes," Hagel told the magazine.

At this point what other option do the 70% of Americans who know Bush is a disaster have?

Bill nails it again.

"New Rule - Traitors don't get to question my patriotism. What could be less patriotic than constantly screwing things up for America?"

[R-Rated language]

Sunday, March 25, 2007

Saturday, March 24, 2007

Thursday, March 22, 2007

Intuit

Intuit has announced dipping sales of the desktop versions of its tax software, raising concerns rival H & R Block is gaining market share. Intuit (nasdaq: INTU - news - people ) shares were down $2.40, or 8.0%, to $27.60 on Thursday after the company announced fiscal year-to-date sales of its consumer tax product and services. Intuit's fiscal calendar ends July 31. The company said it sold approximately 6.0 million copies of its federal TurboTax desktop software, compared with 6.2 million for the year-ago period.

They're losing market share to H&R Block. Do you know how bad you have to suck to lose market share to H&R Block? Pretty darn bad.

Intuit just laid off a bunch of long-time employees, but that didn't solve their real problem, which is bad management. For example, CEO Steve Bennett arrived in January 2000, and the stock price is actually lower today than it was then (yes, adjusted for splits)! How bad is that? I wonder how many millions have been sucked out of the company since 2000 by top managment while shareholders and employees, um, treaded water at best. Hey, they outperformed Enron, that's got to be worth something!

Intuit management is adept at turning cash cows into black holes. Of course, the top execs do just fine thank you, and not just on their ample salaries. Check out their insider stock sales.

Senate Subprime Hearings

Finally, what may be the most important piece of information out of the hearings:

40-60% (depending on the lender) of all borrowers would not be able to qualify for their mortgage if they were forced to qual on the fully-indexed rate for the product they were offered.

Go back and read this again folks. Then read it again. And again. Let it sink in.Half of the customers of these firms over the last two years could not afford the house they bought because they could not afford the fully indexed rate on a mortgage - whether it be a conventional fixed product or some form of ARM!

Again - approximately one half of all mortgage originations over the last two years should not have happened at all, and if these rules are put in place going forward, one half of all originations will disappear from mortgage broker's offices and mortgage companies.

Now ask yourself - how many of the companies in this space survive if they (1) have to deal with the inevitable regulation, back-charges and lawsuits that will come out of this in the next year or two, and (2) their income stream from new customers is cut by 50% at the same time.

This smells like ENRON and MCI/Worldcom all over again.

Good Grief

What an unhappy anniversary. It is four years since the invasion of Iraq and the overthrow of the tyrant Saddam Hussein. And the more time passes, themore this military adventure looks like a disaster for everyone concerned. Not least the people of Iraq.

The large-scale opinion poll conducted there by the BBC and others may not have been as scientific as conditions of peace would permit, but its verdict is a damning one. Asked if life was good, two years ago 71 percent said yes, but now that figure has almost halved.

Fewer than one in five has confidence in the coalition forces, and 51 percent say that attacks on the occupying troops are justified.

Half of those who responded said life is worse now than under Saddam.

Even the Iraqi weightlifting champion who, four years ago, was famously filmed pounding a statue of Saddam with a sledgehammer, said: "The Americans are worse than the dictatorship. Every day is worse than the previous day." It was bound to get worse before it got better, the remaining few apologists for war say. But how long must we persevere with this unchanged policy before we admit that we are not going to turn any corner?

By the way, the weightlifter, Kadhim al-Jubouri, is a guy picked by the Americans to smash the statue, and a guy who actually spent time in Abu-Ghraib under Saddam, sent there by Uday. Now even he says it's worse than before.

What a waste of time, money and blood that could've been better spent in northwest Pakistan going after the cockroaches who hit us on 9/11.

Unreal.

How many more days until January 20, 2009??

Gas Prices

Good thing the government says there's no inflation.

Wednesday, March 21, 2007

Tony Snow, Having Already Sold His Soul, Opines on Constitutional Law

The piece talks about how Snow flip-flops (again) on the issue of executive privilege - i.e., what was bad for Clinton is good for Bush. However much Bush may protest Congress' attempt to have his aides testify under oath about the US Attorney firings, it's already settled law. Hopefully the current court won't anoint Bush king, but anything can happen.

The piece talks about how Snow flip-flops (again) on the issue of executive privilege - i.e., what was bad for Clinton is good for Bush. However much Bush may protest Congress' attempt to have his aides testify under oath about the US Attorney firings, it's already settled law. Hopefully the current court won't anoint Bush king, but anything can happen.

From Think Progress...

The leading case on executive privilege is United States v. Nixon, where the Supreme Court found that executive privilege is sharply limited:

The President’s need for complete candor and objectivity from advisers calls for great deference from the courts. However, when the privilege depends solely on the broad, undifferentiated claim of public interest in the confidentiality of such conversations, a confrontation with other values arises. Absent a claim of need to protect military, diplomatic, or sensitive national security secrets, we find it difficult to accept the argument that even the very important interest in confidentiality of Presidential communications is significantly diminished by production of such material for in camera inspection with all the protection that a district court will be obliged to provide.

Tuesday, March 20, 2007

Is This Guy Still Employed, and If So, Why? (Example #1)

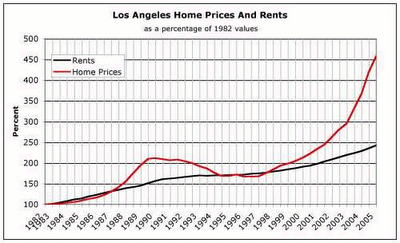

...The reality is this: There is no housing bubble in this country....

- Myth #1. There is too much capacity...

- Myth #2. Risky mortgage products are fueling house appreciation....

- Myth #3. Speculators are Driving Home Prices....

Wisdom courtesy of Neil Barsky, July 28, 2005

Who is to Blame for the Mortgage Carnage and Coming Financial Disaster?

(Here's a hint as to who Roubini says is to blame - it was not government overregulation...think more along the lines of unbridled Neo-Con Republican Voodoo Darwinian Capitalism at its finest, except that the huge rewards went to a few and now the huge costs will be covered by all of us!)

Given the fallout and real, social and financial costs of this disaster the political blame game will soon start. So it is important to make sure that the self-serving spin game that accompanied the game of those who happily ignored since last summer the looming housing, mortgage and economic mess will not be repeated again. Powerful political and financial interests will spin their self-serving ideological spin on who is to blame for this mess. Specifically be ready for a cabal of supply side voodoo ideologues - from the Wall Street Journal editorial page (and its invited op-ed writers) to hacks* (calling them economists would be an insult to my profession) such as Arthur Laffer, Steve Hanke and other assorted voodoo religion priests - to start spinning a tale blaming government regulation and interference for this disaster that has instead its core in the lack of sensible government regulation, not the existence of such regulation. In the meanwhile powerful financial interests that repeat the mantra – or better the proof-less dogma - of unregulated free markets and do not like any – even sensible – supervision and regulation of the financial system will happily blame government action – rather than their own reckless greed and stupidity - for this disaster while happily demanding and receiving billions in bailout funds from the same government that they so happily disdain. This will be the most appalling form of corporate welfare: privatize the profits in good times and socialize the losses in bad times.

(*He didn't mention Larry Kudlow here, so I will.)

Now, here Ron Paul has a different view...

But capitalism is not to blame for the housing bubble, the Federal Reserve is. Specifically, Fed intervention in the economy-- through the manipulation of interest rates and the creation of money-- caused the artificial boom in mortgage lending.

I think Congressman Paul is right, but so is Roubini - this situation involves a tragic combination of shortsighted government intervention and lack of oversight. Of course, either way, the costs will be socialized, and those who reaped millions on this bubble will be just fine. That's the way these things work.

Update: James Grant, with another view, blames "humanity" and the credit rating agencies. I agree with him too.

Monday, March 19, 2007

Bush's Ignoble Disaster

National security advisor Stephen J. Hadley said Sunday that congressional Democrats' efforts to put time limits on the Iraq war could doom U.S. military efforts and leave the strife-torn country a hub of international terrorism.

Terrorists "want to get a safe haven in Iraq from which they can then destabilize neighboring regimes and come and plan actions against the United States," Hadley said on CNN's "Late Edition."

As the war is about to enter its fifth year, lawmakers, military experts and pundits are assessing its progress and cost.More than 3,200 members of the U.S. military and an estimated 60,000 Iraqis have been killed since the U.S.-led invasion on March 20, 2003.

By the end of 2007, the war's price is expected to reach $500 billion.

Hadley said the result would justify the bloodshed and other sacrifice. "The cost has been enormous for the Iraqis. The interesting thing is that the Iraqis are nonetheless willing to pay it," he said on ABC's "This Week."

Others strongly disagreed.

"If you're asking me about it, no, I don't think it was worth it at all," retired Army Col. Pat Lang, a former defense intelligence analyst and an Iraq specialist, told "Late Edition." "I think it was not, in fact, an essential part of the war against the jihadis across the world and has been a diversion from that and has put us in a real mess."

...and in a related story by Kitty Kelley......Democrats also challenged Hadley's assertion that continuing the U.S. operation in Iraq was the way to win the U.S.-declared war on terrorism. "The central front of terror is not in Baghdad," Rep. Joe Sestak (D-Pa.), a retired three-star Navy admiral, said on "Meet the Press." "Osama bin Laden has not moved there."

Resources now devoted to Iraq would be better spent in Afghanistan and Southeast Asia, Sestak said.

...The president tells us Iraq is a "noble" war, but his wife, his children and his nieces and nephews are not listening. None has enlisted in the armed services, and none seems to be paying attention to the sacrifices of military families. Until Jenna's trip to Panama, the presidential daughters performed community service only when mandated by a court after they were cited for underage drinking. Since then they have surfaced in public during lavish presidential trips with their parents, bar-hopping outings in Georgetown and champagne-popping art openings in New York.

The first lady, so often lauded for her love of literacy, has not been seen in the reading rooms of veterans' hospitals. The president's sister, Doro, publicly picketed Al Gore's last days in the vice president's mansion as he awaited the Supreme Court's decision on the Florida recount of 2000. Yet she has been strangely absent from publicly supporting her brother's war.

The presidential nieces and nephews also have missed the memo on setting a good public example. Ashley Bush — the youngest daughter of the president's brother, Neil, and Neil's ex-wife, Sharon — was presented to Manhattan society at the 52nd Annual International Debutantes Ball at the Waldorf Astoria. Her older sister, Lauren, a runway model, told London's Evening Standard that she is a student ambassador for the United Nations World Food Program, but she would not lobby her uncle for U.S. funds. Her cousin, Billy Bush, chronicles the lives of celebrities on "Access Hollywood."

"Uncle Bucky," as William H.T. Bush is known within the family, is one presidential relative who has profited from the Iraq war. He recently sold all of his shares in Engineered Support Systems Inc. (ESSI), a St. Louis-based company that has flourished under the president's no-bid policy for military contractors. Uncle Bucky told the Los Angeles Times that he would have preferred that ESSI, on whose board he sits, was not involved in Iraq, "but, unfortunately, we live in a troubled world.

"The only member of the Bush family to show the strains of our "troubled world" is former President George H.W. Bush, who shed tears recently while addressing the Florida Legislature. The elder Bush was talking about son Jeb's gubernatorial loss in 1994. Jeb, who was later elected, tried to console him. But the sobs of Bush 41 seemed to be more about his older son's "noble" war.

Perhaps the father's sadness sprang from his own experience fighting in what his parents called "Mr. Roosevelt's war" — the good war — the war that saved the world from tyranny. He enlisted at 18 to fly torpedo bombers. He flew 58 missions in two years and returned home a war hero. Since then, no one in his large family has seen fit to follow his sterling example of service and patriotism.

The sick red-herring argument proponents of the Iraq Occupation like to use is that Iraq is the central battle of this great war with "terror". They claim that to retreat from Iraq is to surrender to the terrorists. The truth is that Iraq has become a snakepit of Islamic and Baathist terrorists, solely because of the US invasion of choice and the President's incredibly inept "leadership" (Obviously his leadership of his own family is equally absent).

Again, for the Fox news viewers, invading Iraq after 9/11 made about as much sense as invading Argentina in 1941 because Japan bombed Pearl Harbor. None.

Our real enemy is the Sunni Islamic death-cult jihadis, nominally led by Osama Bin Laden and of course sponsored by our "great allies", Saudi Arabia and Pakistan.

The threat still lies mainly in those two countries and Afghanistan, not Iraq.

How many of the 9/11 hijackers were Iraqi again?

Saturday, March 17, 2007

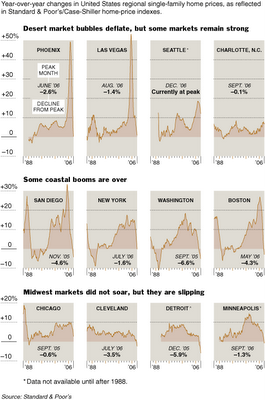

It's Not the Subprime, It's the Alt-A

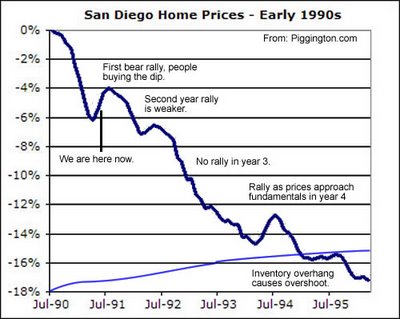

...Let's say you have a $750,000 house. You took a first mortgage as a "2/1 10%" ARM, which is a common ALT-A product. Its cheap because the interest rate is only locked for two years, then it floats at LIBOR (a commonly used interest rate benchmark) plus some percentage. You then took an "option interest" loan for the rest (down payment, what's that?) or even better, you borrowed the downstroke somewhere, then paid it back using a "silent second" - a Home Equity line (HELOC) that had an "option interest" feature.

Well, now the chickens are coming home. Your house has actually depreciated in value by 10% because, well, nobody's buying right now. So you have a $750,000 house with a $750,000 mortgage but the house is only worth $675,000! What's worse is that the interest rate is about to reset 2% up from your "teaser rate", and you know you can't make the payments three months from now.

So you shop for a $500,000 house (remember, its a down market!) You qual for that mortgage (your FICO score is still quite good, as you haven't blown a payment yet) on the basis of selling the OTHER house. You get the loan on THAT house, but its an ALT-A product too; you simply lie about your income, and since its a no-DOC loan and your FICO is in the 650 range, it goes right through.

You move in, then default on the original $750,000 loan!

This is happening all over California, and the bank is left holding the bag!

Note that NONE of this is happening in the Subprime space - its all in ALT-A!

And virtually ALL of the lenders are exposed to the ALT-A mess...

Found the link to the above at the Mortgage Lender Implode-O-Meter site I mentioned back in January. Two months later the implosions of lenders are, um, exploding. But everything is ok. Keep shopping.

VOTD: Zbigniew Brzezinski on the Daily Show

Jon Stewart: "The premise basically is this: since America took over the role as the dominant superpower, when the cold war ended, we've had three presidents, all with an opportunity to capitalize on that success, and in your mind, the first President Bush did a reasonable job, got a B...Clinton got a C, and uh, this President, I believe, if I'm quoting your book correctly, an F?"

ZB: "That is, sad to say, true."

Friday, March 16, 2007

2+2=5

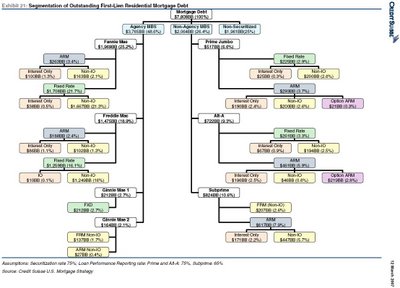

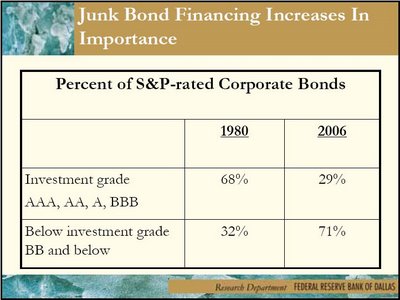

Today I will follow a debt trail, from loan origination all the way to itsultimate existence as part of a credit derivative product. I will use a sup-prime mortgage loan as an example, but any debt obligation will do. Keep the question of the title in mind, it will make sense in the end.

Let's start two years ago with Ron and Ronda White, a couple in their early 30's with a combined income of $60.000 who have their eyes set on a $300.000 house to call home. They have saved only $5.000 to put down, which barely covers the closing costs. Their mortgage broker talks them into a $250.000 first mortgage ARM with an initial 2-year teaser rate of 2% rising to prime+1% thereafter and a $50.000 second, 30-year fixed at a whopping 10.5%. Despite the obvious problems apparent right from the start, such loans were made to hundreds of thousands of people. But no matter...

The two loans were immediately sold to investment bank XYZ who pooled them with other loans (creating Residential Mortgage Backed Security, or RMBS) and placed them inside a CDO. Using recent default data, the financial engineer employed by XYZ took 90% of the White's outstanding mortgage amount and placed it in CDO Tranch A, the supposedly safest portion rated AAA and paying 0.10% more than other AAA straight corporate bonds. The rest was apportioned 7% to Tranch B rated BBB, paying 1.5% more than equivalent bonds and the remaining 3% to Tranche C, also known as the "equity" tranche, which was unrated and paying 10% above Treasury bonds. In case of default, Tranche C gets hit first until it is exhausted, then Tranche B and, finally, Tranche A. This is a "cascade" or "waterfall" pattern, common to all such collateralized products.

Notice how 100% of a loan package that could be described as CCC has been turned into 90% AAA, 7% BBB and 3% NR. In plain terms, the "engineer" is betting that no more than ~3% of the total principal and interest will be lost, including recoveries from selling foreclosed real estate.

More at Sudden Debt.

Thursday, March 15, 2007

Wednesday, March 14, 2007

Tuesday, March 13, 2007

More Fun With Borrowed Money

Amazingly, for most journalists, analysts, CNBC anchors etc., yes. Blogs like Bubble Markets Tracking Inventory have been covering the insanity of the housing and credit bubbles for two or more years now, and when the mainstream media finally starts to report on the issue they miss the forest for the trees. Just like the feeble, cowardly reporting (in general) by the MSM on the Iraq fiasco.

Update: http://bubbletracking.blogspot.com/2007/03/thank-you-los-angeles-times.html

*Shorting the financials (i.e., buying SKF) would probably not be the worst thing in the world to do now!

*This is not investment advice and should not be construed as such. If you buy SKF and financial stocks go up, which they usually do, you will lose money. Probably a lot of money that could've been better spent on a plasma TV.

Monday, March 12, 2007

Halliburton Moves to Dubai

...Halliburton CEO David Lesar said that while he will maintain an office in Houston, the corporate headquarters for Halliburton will be relocated to the United Arab Emirates.

...In recent years, however, Halliburton has frequently been accused of receiving special favors in the procurement of lucrative contracts in Iraq, where it has been active in providing civilian support for the war effort. Many of these accusations appear to have been related to Vice President Dick Cheney's position as CEO of the company from 1995 to 2000.

Saturday, March 10, 2007

Newsflash: 2007 Days Since 9/11 And Bin Laden Still Roams Free.

Heckuva job, GW.

Friday, March 09, 2007

Thursday, March 08, 2007

Wednesday, March 07, 2007

Insider Selling

This huge insider selling is typical of most large public companies, where the main purpose of the enterprise is to enrich the top executives at the expense of the employees and shareholders. This is of course on top of monstrous salaries and other executive compensation.

Some other typical examples:

Intuit (INTU) $160 million in sales, $361,000 in buys

New Century Financial (NEW) $59 mil in sales, $430,000 worth bought

Google (GOOG) $8 billion sales, 0 (zero) buys

Microsoft (MSFT) $3.9 billion sales, $399,000 buys

General Electric (GE) $10.4 billion sales, $12 million buys

Who's buying when those in the know are selling?

Greenspun

"Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. . . . With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. . . . Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending . . . fostering constructive innovation that is both responsive to market demand and beneficial to consumers."

-Remarks by Chairman Alan Greenspan on Consumer Finance At the Federal Reserve System’s Fourth Annual Community Affairs Research Conference, Washington, D.C. April 8, 2005

Eventually Alan Greenspan will be recognized not as a "maestro", but as the main enabler of the credit debacle now just starting to unfold.

Good News

According to a study of 311 women carried out by researchers at Stanford University, USA, the Atkins diet is the best one around. Those following the Atkins diet had best blood pressure levels, better cholesterol levels and lost the most weight, compared to people on other diets, say the researchers.

The Real Story

...Perhaps now that Libby has gone down for his part in this grotesque crime, some editor will ask the obvious question: Why did the White House and the Office of Vice President go to such extraordinary lengths to attack Wilson and his wife? And more importantly, who was behind those Niger embassy burglaries and the forged uranium ore sale documents? And what was OSP [Defense Department Office of Special Plans] doing meeting in Rome in December 2001 with the head of Italian intelligence?

Make no mistake: this whole story has the odor of a "black op" designed to target the American people.

If so it was an act of high treason.

It is not just Libby who should go to jail for this crime. It is the president and vice president...

Tuesday, March 06, 2007

All You Need To Know About "The Greatest Story Never Told"

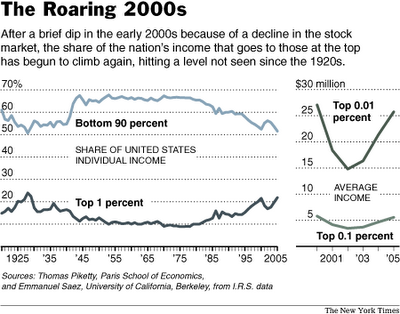

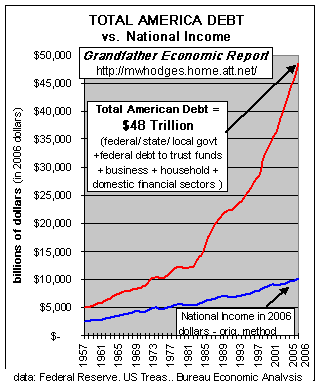

Second, America's economic mirage is based upon debt that just ain't gonna get paid back. If you disagree, go ahead buy a 30-year US Treasury Bond today yielding 4.66%. I dare you. I triple-dog dare* you.

A dollar from 1977 is worth 30 cents today (and that's using the government's own bogus low-CPI figures).

The headline above of course refers to CNBC neo-tool Larry Kudlow's oft-spouted opinion of some imagined GW Bush economic nirvana, which of course it sort of appears to be to the neo-con billionaires that Kudlow hangs out with after playing squash and cricket and polo (horse, not water). Thurston Howell could kick Kudlow's butt.

The headline above of course refers to CNBC neo-tool Larry Kudlow's oft-spouted opinion of some imagined GW Bush economic nirvana, which of course it sort of appears to be to the neo-con billionaires that Kudlow hangs out with after playing squash and cricket and polo (horse, not water). Thurston Howell could kick Kudlow's butt.

*Note: The infamous Triple-dog-dare is infamous for the sole reason that you cannot back down from it--without exception! An issued triple-dog-dare has no counteraction and must be implemented and/or carried out.

Fall Guy

Juror Explains Libby Verdict: They Felt He Was 'Fall Guy'

By Greg Mitchell

Published: March 06, 2007 1:30 PM ET

NEW YORK A spokesman for the jury that convicted "Scooter" Lewis of four counts today of perjury and obstruction of justice today in a federal courtroom told reporters immediately afterward that many felt sympathy for Libby and believed he was only the "fall guy."

Denis Collins said that "a number of times" they asked themselves, "what is HE doing here? Where is Rove and all these other guys....He was the fall guy."

He said they believed that Vice President Cheney did "task him to talk to reporters".

"He said, "some jurors said at one point, 'We wish we weren't judging Libby...this sucks." More than once he said many jurors found Libby "sympathetic."

Asked about Vice President Cheney not testifying, he said, "Having Cheney testifying would have been interesting." And when the defense opened the trial by suggesting that Libby was scapegoated by the White House, "I thought we might get to see President Bush here."

No such luck.

Monday, March 05, 2007

New Century Financial

New Century Financial just announced a criminal probe into the trading of its securities, and its accounting procedures. The NY Times has a great article today on this latest way for a few people to get millions of dollars through good old fashioned hard work...

Even in affluent Orange County, Calif., the growing wealth of executives and brokers in the booming mortgage industry was hard to miss.

For Kal Elsayed, a former executive at New Century Financial, a large lender based in Irvine, driving a red convertible Ferrari to work at a company that provided home loans to people with low incomes and weak credit might have appeared ostentatious, he now acknowledges. But, he says, that was nothing compared with the private jets that executives at other companies had. “You just lost touch with reality after a while because that’s just how people were living,” said Mr. Elsayed, 42, who spent nine years at New Century before leaving to start his own mortgage firm in 2005. “We made so much money you couldn’t believe it. And you didn’t have to do anything. You just had to show up.”

Don't worry, the Top Executives, as always, will be fine.

New Century’s stock price, which seemed to mirror the trajectory of the subprime business, peaked at nearly $66 a share in December of 2004 and traded in the $40s most of last year; on Friday, it was trading at $11 a share after the market closed. In a series of sales from August to November, two of the company’s founders sold shares for an average price of about $40 a share, for a total profit of $21.4 million.

...Robert K. Cole, 60, a co-founder who retired as chairman and chief executive last year, lives in a 6,100-square-foot oceanfront home in Laguna Beach that is valued at tens of millions of dollars...

I wonder if Mr. Cole used a 100% no-doc option ARM to buy his mansion (probably just paid cash).

The stock closed below $5 today. This sad employee lovefest is from the New Century website:

"I’ve had so much trust in the three founders [Bob Cole, Chairman and CEO; Brad Morrice, Vice Chairman, President and COO; and Ed Gotschall, Vice Chairman]. They are smart people and they have always made great decisions to grow this company and to make it what it is right now.” [name removed to save probably soon-to-be terminated employee from embarassment], Area Sales Manager, Irvine, California

“All one has to do is listen to the founders when they address stockholders or the rank and file, and the words are always the same: we are the best and we are going to stay that way. They instill a level of confidence and enthusiasm through the entire organization.” [ditto], Area Sales Manager, Bloomington, Minnesota

“We would be lucky to have just one of these guys leading our company, let alone all three of them.” [good grief], Area Sales Manager, Campbell, California

(Employees probably would have a slightly different opinion of these three today).

Way to go Bob, Brad & Ed! Good thing stupid people weren't running the company!

The Angry Stockbroker

The Gap's profit is down 35%? Good. That's what you get for dressing America in the most emasculating fashion trend since rainbow suspenders....

...DO NOT MAKE YOUR SON WEAR ARGYLE SWEATERS! There are only two career paths for little boys who wear Gap clothes: hairdresser and serial killer.

Check out the whole thing (with great pics) here.